Developed markets are staring at a possible recession while the Indian market continues to bear the brunt of the continuous exodus of Foreign institutional investors (FIIs). The selloff has pulled down Sensex by -8% YTD as of July 11, 2022.

Even as most equity funds have delivered negative returns, the Gold Exchange Traded Fund (ETF) category is up 5.32% YTD as of June 7, 2022. Of late, the yellow metal is losing shine due to a stronger dollar and higher nominal interest rates. The returns of Gold ETFs are down -2.56% in the last three days as of July 7, 2022. Going ahead, World Gold Council (WGC) notes that shifts in monetary policy and geopolitics factors are likely to be positive for the yellow metal.

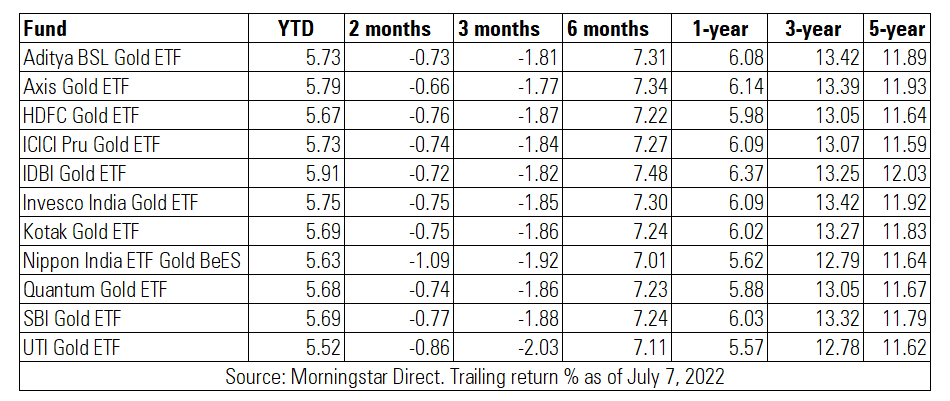

Gold (ETF) Returns

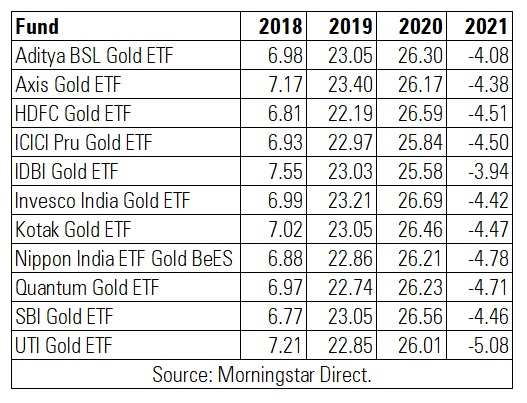

Gold had a spectacular return (up 27.9%) in 2020 when investors rushed to safety during the Coronavirus pandemic. In 2021, the yellow metal lost -1.6%. In the first half of the fiscal year 2022, gold was up 6.9% in INR terms as of June 2022. According to WGC, interest rates and inflation were two of the most important contributors to gold’s performance in 2022.

Gold ETF Returns (Calendar Year)

Gold typically performs well during inflationary environment and investors seem to be rushing to catch this trend. In the past four months (March to June 2022), Gold ETFs have received cumulative net inflows worth Rs 1,644 crore. The rising appetite for gold is evident in the sharp rise in investor accounts/folios. The number of folios in Gold ETFs increased by 170% from 16.68 lakh in May 2021 to 45.06 lakh in May 2022.

So where is gold headed from here?

Chirag Mehta, Chief Investment Officer, Quantum AMC, expects gold prices to be rangebound and volatile in the short term as top central banks prioritize fighting inflation over growth. “With another 75 bps rate hike expected in the U.S. in July. However, in the medium to long term, we expect significant tailwinds to the gold price given that the global economic growth is expected to slow down meaningfully.”

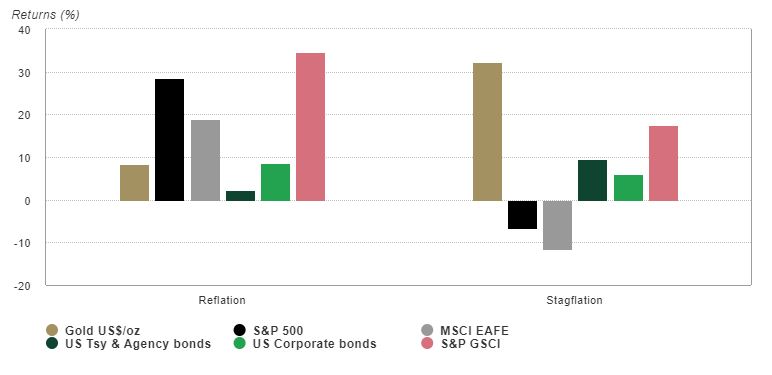

Chirag says that a staflationary environment could support the demand for gold. “An economic slowdown might compel the Central Banks, especially the Fed, to cut interest rates or reduce the quantum of hikes and abandon balance sheet reduction i.e., pulling out liquidity. This would be a pivot from the current aggressiveness, pushing gold prices up. There is a likelihood that the global economy could enter several years of above-average inflation and below-average growth. This stagflationary environment, if materialised, will have destabilizing consequences for the global economy and markets, supporting investment demand for gold.”

Major asset returns per cycle phase since 1973: gold a clear winner in stagflation

Annualised average (stagflation) adjusted returns for major asset classes since Q1 1973*

Image source: WGC * As of Q2 2021.

Rushabh Desai, Founder of Rupee with Rushabh Investment Services, feels that the future trajectory of gold depends on a number of factors. “Gold has corrected as a swift rally in US dollar and rising interest rates along with sell off and weakness in the commodity segment which sapped appetite for the yellow metal. Gold is a very cyclical asset class and it can further see weakness but at the same time if major economies enter into a recession along with the geopolitical concerns it can gain an upward momentum as well.”

Should you invest at this juncture?

Rushabh says that investors should stick to their asset allocation and not rush to invest in gold. “Currently it is very difficult to say where exactly the prices of gold are headed, if someone is looking to invest in gold I would like to wait and watch the global economical data including the USD, interest rates, inflation, and the demand of gold for a couple of months and see if there is more correction in the yellow metal left and then venture in it. At the moment investors should follow their asset allocation strictly and would not suggest rushing in to buy the yellow metal as an investment.”

Shifali Satsangee, Chief Executive Officer, Funds Ve’daa, says that investors can consider taking allocation to gold after factoring in their current portfolio mix and risk appetite.

“A tighter fiscal policy means a fall in marginal propensity to save and consume. Usually, commodity prices (especially precious metals) are the first casualty. However, as risk assets see a further downside trajectory, the flight to safety in the bond market and traditional assets like gold will find a median price level to settle. In India, gold has been a traditional hedge against inflation risk. However, India is dependent on the USD-INR rate and underlying international gold prices. With a depreciating rupee and volatile action of underlying factors, a cautious approach is warranted. One can consider an allocation to gold considering these factors, their current portfolio mix, and risk appetite.”

Is it time to invest in gold?