Hybrid Funds are steadily gaining momentum among investors, which is evident by the steady growth in the category’s asset size.

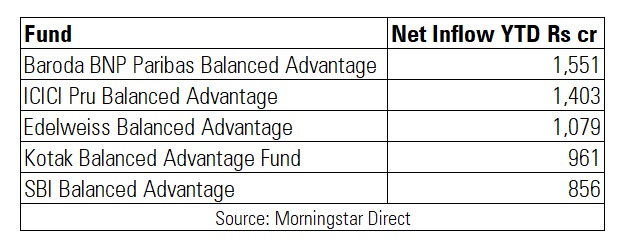

The Balanced Advantage Funds or Dynamic Asset Allocation Funds category received net inflows worth Rs 55,859 crore in the calendar year 2021. So far from January to April 2022, this category has received net inflows to the tune of Rs 8,143 crore.

Balanced Advantage Funds have the leeway to manoeuvre across asset classes like debt and equity based on market valuations. We looked at estimated net inflows across two categories – Balanced Advantage Funds and Aggressive Hybrid Funds from January to April 2022 to understand which funds have received the most inflows.

Highest Inflows YTD – Balanced Advantage Funds

Baroda BNP Paribas Balanced Advantage

- Star Rating: 5 stars

- Inception: November 2018

- Holdings: 80 (Equity), 53 (Bond)

- Top 5 Equity Holdings: Reliance Industries, HDFC Bank, Infosys, ICICI Bank, Hindalco Industries

- Investment Style: Large Growth

- Performance: 12.23% (2019), 27.86% (2020), 18.21% (2021), 14.29% since inception as of May 23, 2022

- Maximum Drawdown: -12.32% (Fund), -15.22% (category)

- Market Capitalisation: 19% (Large Cap), 11.84% (Mid Cap), 5.40% (Small Cap)

- Asset Allocation %: 53.80% (Equity), 26.82% (Bonds), 19.37% (Cash)

- Assets under management: Rs 3,188 crore

- Fund Managers: Sanjay Chawla, Alok Kumar Sahoo, Pratish Krishnan

ICICI Prudential Balanced Advantage Fund

- Star Rating: 4 stars

- Inception: December 2006

- Holdings: 129 (Equity), 44 (Bond)

- Top 5 Equity Holdings: Reliance Industries, ICICI Bank, Infosys, HDFC Bank, Bharti Airtel

- Investment Style: Large Blend

- Performance: 10.79% (2019), 11.71% (2020), 15.14% (2021), 10.85% since inception as of April 23, 2022

- Maximum Drawdown: -19.89% (Fund), -15.22% (category)

- Market Capitalisation: NA

- Asset Allocation %: 36.10% (Equity), 18.98% (Bonds), 44.92% (Cash)

- Assets under management: Rs 39,761 crore

- Fund Managers: Sankaran Naren, Rajat Chandak, Ihab Dalwai, Manish Banthia, Ritesh Lunawat and Sri Sharma

Edelweiss Balanced Advantage Fund

- Star Rating: 5 stars

- Inception: August 2009

- Holdings: 147 (Equity), 14 (Bond)

- Top 5 Equity Holdings: HDFC Bank, Reliance Industries, ICICI Bank, Axis Bank, Infosys

- Investment Style: Large Growth

- Performance: 7.78% (2019), 22.64% (2020), 18.76% (2021), 10.11% since inception as of May 23, 2022

- Maximum Drawdown: -11.66% (Fund), -15.22% (category)

- Market Capitalisation: 95% (Large Cap), 11.47% (Mid Cap), 3.01% (Small Cap)

- Asset Allocation %: 68.20% (Stocks), 11.21% (Bonds), 20.59% (Cash)

- Assets under management: Rs 8,008 crore

- Fund Managers: Bhavesh Jain, Bharat Lahoti, Rahul Dedhia

Kotak Balanced Advantage Fund

- Star Rating: 3 stars

- Inception: August 2018

- Holdings: 175 (Equity), 45 (Bond)

- Top 5 Equity Holdings: HDFC Bank, Adani Ports and Special Economic Zone, Reliance Industries, ICICI Bank, Bharti Airtel

- Investment Style: Large Blend

- Performance: 12.14% (2019), 13.64% (2020), 12.96% (2021), 9.14% since inception as of May 23, 2022

- Maximum Drawdown: -18.07% (Fund), -15.22% (category)

- Market Capitalisation: NA

- Asset Allocation %: 42.52% (Stocks), 22.94% (Bonds), 34.54% (Cash)

- Assets under management: Rs 13,573 crore

- Fund Managers: Harish Krishnan, Abhishek Bisen, Hiten Shah

SBI Balanced Advantage Fund

- Star Rating: NA

- Inception: August 2021

- Holdings: 146 (Equity), 4 (Bond)

- Top 5 Equity Holdings: ICICI Bank, Axis Bank, Housing Development Finance Corp, ITC, National Highways Infra Trust

- Investment Style: Large Blend

- Performance: NA (2019), NA (2020), NA (2021), 0.54% since inception as of May 23, 2022

- Maximum Drawdown: NA (Fund), -15.22% (category)

- Market Capitalisation: NA

- Asset Allocation %: 45.39% (Stocks), 15.83% (Bonds), 37.97% (Cash)

- Assets under management: Rs 24,011crore

- Fund Managers: Dinesh Ahuja, Dinesh Balachandran, Mohit Jain

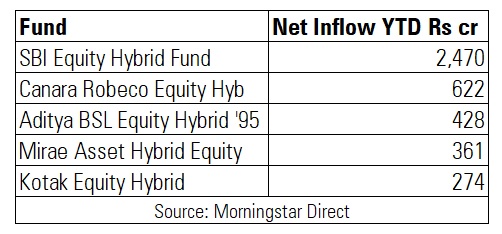

Highest Inflows YTD – Aggressive Balanced Funds

SBI Equity Hybrid Fund

- Star Rating: 5 stars

- Inception: January 2005

- Holdings: 38 (Equity), 46 (Bond)

- Top 5 Equity Holdings: ICICI Bank, HDFC Bank, Reliance Industries, Infosys, Divis Laboratories

- Investment Style: Large Blend

- Performance: 13.49% (2019), 12.90% (2020), 23.60% (2021), 14.93% since inception as of May 23, 2022

- Maximum Drawdown: -19.50% (Fund), -20.82% (category)

- Market Capitalisation: NA

- Asset Allocation %: 70.73% (Stocks), 12.50% (Bonds), 16.76% (Cash)

- Assets under management: Rs 50,933 crore

- Fund Managers: R Srinivasan, Dinesh Ahuja, Mohit Jain

Canara Robeco Equity Hybrid Fund

- Star Rating: 4 stars

- Inception: February 1993

- Holdings: 52 (Equity), 38 (Bond)

- Top 5 Equity Holdings: ICICI Bank, Reliance Industries, Infosys, HDFC Bank, State Bank of India

- Investment Style: Large Growth

- Performance: 11.67% (2019), 19.68% (2020), 22.76% (2021), 11.26% since inception as of May 23, 2022

- Maximum Drawdown: -16.27% (Fund), -20.82% (category)

- Market Capitalisation: NA

- Asset Allocation %: 71.16% (Stocks), 14.75% (Bonds), 14.16% (Cash)

- Assets under management: Rs 7,662 crore

- Fund Managers: Avnish Jain, Shridatta Bhandwaldar, Ennette Fernandes

Aditya Birla Sun Life Equity Hybrid 95 Fund

- Star Rating: 3 stars

- Inception: February 1995

- Holdings: 65 (Equity), 74 (Bond)

- Top 5 Equity Holdings: ICICI Bank, Reliance Industries, HDFC Bank, Infosys, State Bank of India

- Investment Style: Large Growth

- Performance: 4.75% (2019), 11.67% (2020), 24.17% (2021), 18.36% since inception as of May 23, 2022

- Maximum Drawdown: -16.27% (Fund), -20.82% (category)

- Market Capitalisation: NA

- Asset Allocation %: 77.33% (Stocks), 15.09% (Bonds), 7.59% (Cash)

- Assets under management: Rs 8,204 crore

- Fund Managers: Dhaval Shah, Satyabrata Mohanty, Harshil Suvarnkar

Mirae Asset Hybrid Equity Fund

- Star Rating: 4 stars

- Inception: July 2015

- Holdings: 67 (Equity), 34 (Bond)

- Top 5 Equity Holdings: ICICI Bank, HDFC Bank, Infosys, Reliance Industries, Axis Bank

- Investment Style: Large Growth

- Performance: 11.93% (2019), 13.65% (2020), 23.77% (2021), 11.16% since inception as of May 23, 2022

- Maximum Drawdown: -21.19% (Fund), -20.82% (category)

- Market Capitalisation: NA

- Asset Allocation %: 74.17% (Stocks), 16.30% (Bonds), 9.53% (Cash)

- Assets under management: Rs 6,649 crore

- Fund Managers: Mahendra Kumar Jajoo, Harshad Borawake, Vrijesh Kasera

Kotak Equity Hybrid

- Star Rating: 3 stars

- Inception: November 2014

- Holdings: (Equity), (Bond)

- Top 5 Equity Holdings: ICICI Bank, Infosys, HDFC Bank, State Bank of India

- Investment Style: Large Growth

- Performance: 14.14% (2019), 15.38% (2020), 28.88% (2021),10.70% since inception as of May 23, 2022

- Maximum Drawdown: -25.50% (Fund), -20.82% (category)

- Market Capitalisation: NA

- Asset Allocation %: 75.35% (Stocks), 14.52% (Bonds), 10.13% (Cash)

- Assets under management: Rs 2,554 crore

- Fund Managers: Abhishek Bisen, Pankaj Tibrewal

ALSO READ: